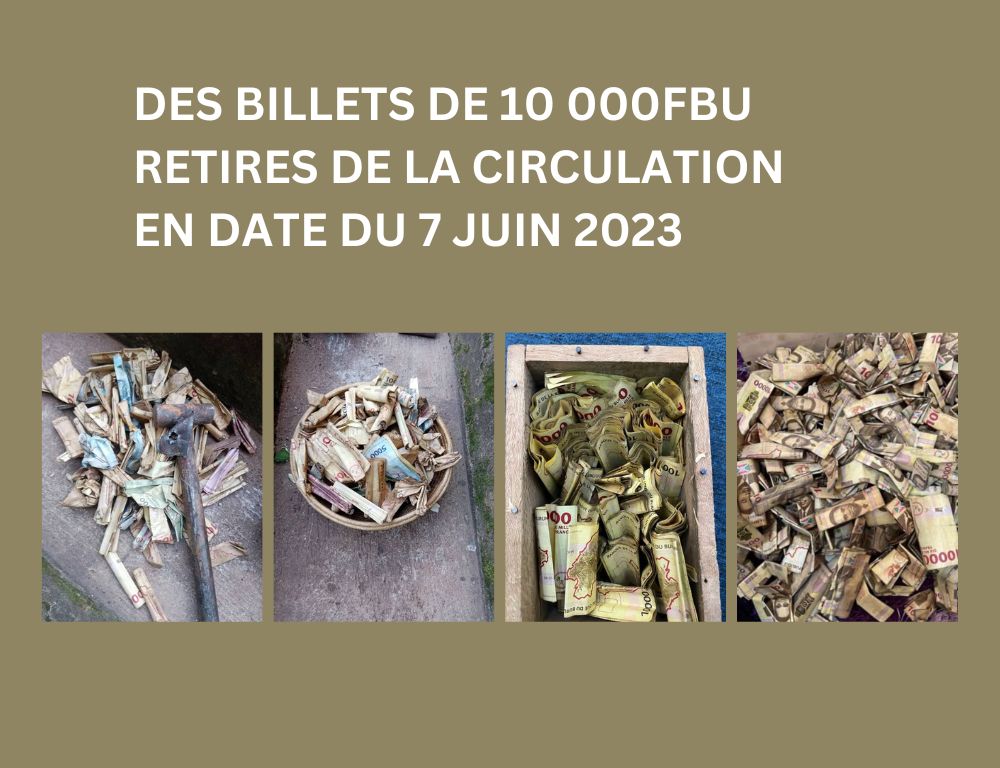

President Evariste Ndayishimiye had warned that he was going to transform banknote bundles into paper, and the decision has just been taken: from June 7 to 17, 2023, all 10,000 and 5,000 banknotes are to be changed under conditions tailored to facilitate the objective.

The Central Bank’s decision to exchange the 10,000 and 5,000 bills with the new ones within ten days is followed by a series of measures such as :

No deposits of more than 10 million a day are allowed, open bank accounts must be regularly registered and reported to the BRB, no daily exchange of new bills of more than 100,000FBu is allowed, etc…

Why this measure?

As the BRB press release states, there is a shortage of 10,000 and 5,000 banknotes in the banks.

Indeed, traders have been exchanging money hand to hand in recent days. According to investigations by Journal Itara Burundi, there are five main reasons for this behavior:

Burundi’s banks and microfinance institutions have built up a system that hinders the personal development of their customers, by granting loans with great difficulty, at very high rates and with conditions that are unaffordable for the majority of the population. Some microfinance institutions behave like banks, to the point of holding colossal sums of money in their accounts, while their customers are impoverished on a daily basis. Our sources denounce the cases of MUTEC, CECADM and EDEN, etc., which cannot justify their funds once an impartial audit has been carried out. The length of time it takes for a loan to be granted does not help small traders to develop, as they can go up to three months without receiving a loan they have applied for.

A number of international NGOs working in Burundi have been instrumental in promoting an economic revival based on the use of bank accounts: tontines, CIRC, Ibirimba, etc. Various names are attributed to this type of economic model, which facilitates rapid access to credit between traders without recourse to banking institutions. Our sources told us that a group of people could exchange over 50 million very easily and that many people have already seen their businesses grow very easily and the banks would have refused to open accounts for this kind of business so they are not solicited accordingly.

The Lambert banks played an important role in the boycott of bank use, as merchants, military personnel on missions abroad and anyone else who wanted a loan to Burundians would turn to the Lambert bank (a person who gives high-interest loans for a short period of time) for fear of not meeting the conditions of banks and microfinances when funds were urgently needed.

The big tycoons who hide their assets so as not to be exposed, especially corrupt officers and officials and those who practice illicit enrichment. Our sources suspect that the camp of those close to former President Pierre Nkurunziza is under threat from the current government.

People who don’t know the point of depositing money in bank accounts and prefer to keep it on their person.

The people contacted by the Itara Burundi newspaper differ on this fight, as President Evariste Ndayishimiye predicted on the eve of this BRB measure:

Some see this measure as an effective takeover of Neva’s power, breaking a vicious circle that is stifling the national economy in one way or another, while others blame the government for having approved more than a hundred banks and microfinances, without drawing up guidelines to facilitate access to bank loans at reasonable rates, as is the case in countries in the sub-region.

Leave a Reply